Project Risks/ Mitigating Factors

The Project Team has spent the past three years verifying the need for at the Lopez Food Center Project. Extensive surveys of project stakeholders, community meetings and one-on-one interviews were undertaken between 2020 and 2023. Demand for the LFC was confirmed but questions remained over project financial feasibility – raising sufficient funds to pay for Project development and structuring it to be affordable to potential users.

The typical customers of the Food Center, including its anchor tenants, have limited financial resources. Other than the LIFRC and San Juan Islands Food Hub, these tenants are not able to firmly commit to using a facility that is several years away from opening for business. For this reason, the Project has been structured assuming that several layers of reserve funds will be available to subsidize any shortfall in payment of operating expenses.

In evaluating the risks to the Project’s cash flow from grant funded non-profits as tenants, consideration must be given to the purpose of the non-profits, their history in the community and the array of grants which have been historically available from foundations, federal, state and local governments to support their missions. You also need to take into consideration the location of the Project in the heart of Lopez Village and the potential for replacement tenants for the space if needed. The Recovery Café is part of a nationally recognized mental health program with a successful track record. Food Banks are nationally recognized as providing vital services to their communities. Even if these organizations experienced revenue shortfalls for a few years, it is highly unlikely that they would be closed permanently.

Operating Proforma

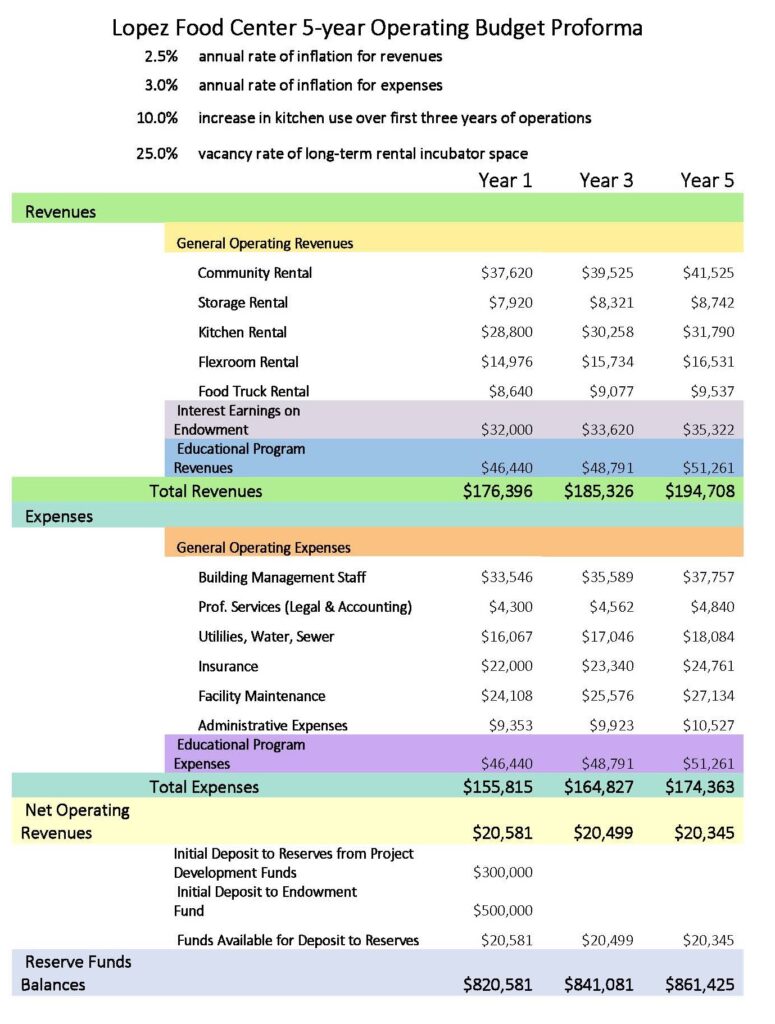

Once construction is completed, the Project is expected to be self-supporting. This assumes a 2.5% inflationrate for Project revenues, a 3% inflation rate for Project operating expenses, a 25% vacancy rate in business incubator space and seasonal fluctuations in rental of storage space and that tenants pay current market rate rents. Interest earnings on the Endowment Fund ($500,000), the Operating Reserve and Replacement Reserve ($300,000) will also be used to pay operating and maintenance expenses. Reserve funds are assumed to be invested at 4%.

On-going maintenance and operation expenses for the Project will be covered by rental fees for the community kitchen, food bank area, San Juan Islands Food Hub distribution area, food storage space (dry, refrigerator, freezer) community event space, business incubator and pop-up retail space.

Educational programs will be grant funded and structured to cover all related operating and overheadexpenses.

The following table shows projected cash flow for the first 5 years of Project operation.

A stress test of revenue and expense assumptions shows that even if net income projections are off by 150%, the Project does still not draw on the principal amount of its Endowment Fund during its first 10 years of operation.